The Modern SaaS Sales Funnel: A Director’s Blueprint for Scaling Revenue

Posted in :

The SaaS sales funnel isn’t just a process; it’s the economic engine of your company. Unlike traditional product sales, it’s a marathon, not a sprint, designed to maximize Customer Lifetime Value (LTV). This guide breaks down this engine, providing a actionable blueprint for building a predictable, scalable revenue machine.

1. Beyond the Funnel: The SaaS Revenue Engine

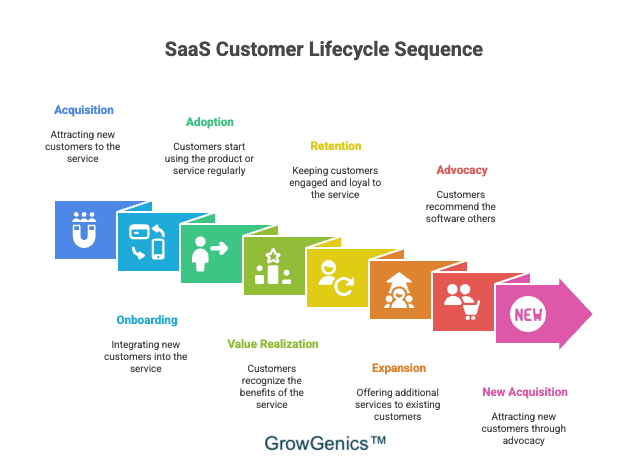

Traditional sales funnels end at the purchase. In SaaS, the purchase is just the beginning. The core differentiator is the shift from a transaction to a relationship.

-

Subscription Economics: Your success isn’t measured by a single deal size but by LTV, Monthly Recurring Revenue (MRR), and churn rate. A high churn rate can nullify the best customer acquisition efforts.

-

The Critical Role of Customer Success: Sales and marketing don’t own the funnel alone. Customer Success is now a core revenue function, responsible for retention, expansion, and turning customers into advocates.

2. Deconstructing the Stages: A Data-Driven View

While stages are similar, the key performance indicators (KPIs) at each stage are unique to SaaS. Here’s what I track on my dashboards:

| Stage | Primary Goal | Key SaaS Metrics |

|---|---|---|

| Awareness | Attract Potential Users | Website Traffic, Top-of-Funnel Conversion Rate |

| Evaluation | Educate & Qualify | Marketing Qualified Leads (MQLs), Content Engagement |

| Decision | Prove Value | Sales Qualified Leads (SQLs), Demo-to-Trial Conversion Rate |

| Conversion | Acquire Customer | Customer Acquisition Cost (CAC), Closed-Won Rate |

| Onboarding | Drive First Value | Time to First Value, Activation Rate |

| Adoption | Cultivate Usage | Daily/Monthly Active Users (DAU/MAU), Feature Adoption |

| Retention | Renew Subscription | Net Revenue Retention (NRR), Gross Retention |

| Expansion | Grow Revenue | Expansion MRR, Number of Seats/Products per Account |

3. Lead Generation: Quality Over Quantity

In SaaS, a poorly qualified lead is more than a wasted sales call; it inflates your CAC and increases churn risk if they ever do sign up.

-

Case Study: HubSpot’s Inbound Dominance

HubSpot didn’t just preach inbound marketing; they built an empire on it. By creating an immense library of free, valuable content (blogs, tools, certifications), they attract millions of visitors and generate leads who are already educated on the value of marketing and sales software. This dramatically increases lead quality and lowers their sales resistance. -

Outbound for SaaS: Outbound is not dead, but it’s surgical. It’s for targeting specific accounts (Account-Based Marketing). Tools like ZoomInfo and Sales Navigator allow reps to build hyper-targeted lists, and personalized outreach sequences (via Outreach.io or Salesloft) can start genuine conversations with high-intent prospects.

4. The Power of Education: Your Secret Weapon

SaaS products are often complex and solve multi-faceted problems. Education is how you build trust before you ask for a dollar.

-

Example: A company like Ahrefs doesn’t just sell an SEO tool; they run a massive blog and YouTube channel that teaches SEO. By the time a user needs a tool, Ahrefs is the obvious, trusted choice. They’ve captured the demand they helped create.

- According to a Gartner study, B2B buyers spend only 17% of their time meeting with potential suppliers when considering a purchase. The rest is spent independently researching online. If you aren’t providing that research, you’re invisible.

5. The Moment of Truth: Demo and Trial

This is where marketing leads become sales opportunities. The goal is not to show every feature, but to deliver a “aha!” moment as quickly as possible.

-

Freemium vs. Free Trial: Slack mastered Freemium—the product itself is the sales tool. Salesforce excels with guided trials—they need to show enterprise clients a customized solution. Your choice depends on product complexity.

-

Data Point: A study by OpenView Partners found that prospects who experience a product’s core value (the “aha!” moment) within the first few days of a trial have a dramatically higher conversion rate.

6. Nurturing & Closing: The Human Touch

Automation scales, but people close.

-

Handling “We’re Already Using X” Objection: This is where a strong competitive intelligence program is crucial. Instead of bashing the competitor, train your reps to say: “That’s a great platform. Many of our customers switched from X because they were looking for [specific unique value prop, e.g., ‘a more intuitive interface that their team would actually adopt’ or ‘deeper integration with Salesforce’]. Can we explore if that’s a challenge for you?”

-

Pricing Strategy: Tiered pricing (e.g., Base, Pro, Enterprise) is standard for a reason. It allows customers to self-select into the package that fits their needs and budget. Always have an “Enterprise” tier with custom pricing for your largest deals.

7. Onboarding & Retention: Where the Real ROI Is

Acquiring a customer is a cost; retaining them is profit.

-

-

How Slack Onboards for Victory

Slack’s onboarding is a masterclass. It’s not about learning software; it’s about achieving a goal (“Start using Slack with your team”).

-

It guides you to invite teammates immediately, driving network effects and stickiness from day one. Their activation metric is likely “sending messages in a channel,” and they design the entire experience to achieve that.

- The North Star Metric: Net Revenue Retention (NRR)

This is the most important metric in SaaS. NRR > 100% means your existing customer base is growing through upsells and cross-sells faster than it’s shrinking from churn. Companies with high NRR are incredibly valuable because they can theoretically grow revenue even if they stop acquiring new customers. According to SaaS benchmark data from SaaS Capital, the median NRR for public SaaS companies is 110%. Top performers exceed 125%.

8. Future-Proofing Your Funnel

-

Product-Led Growth (PLG): This isn’t just a trend; it’s a fundamental shift. The product is the primary driver of acquisition, conversion, and expansion. Figma and Notion beat entrenched competitors by being so intuitive and viral that users demanded their companies adopt them. Sales then focuses on closing the enterprise deal, not the initial user.

-

AI & Personalization: AI is moving beyond lead scoring. It’s about predicting churn risk, identifying expansion opportunities, and personalizing the user experience in real-time at scale.

Conclusion: Funnel to Flywheel

Stop thinking of your sales process as a funnel where leads leak out. Start building a flywheel. Every retained customer, every success story, every piece of user-generated content becomes force that attracts and accelerates new business. Fuel this flywheel with relentless focus on customer value, and you will build a durable, scalable SaaS enterprise.

References:

-

For an authoritative, data-backed deep dive into the economics and strategies discussed, I consistently recommend the annual “SaaS Benchmarks” report from KeyBanc Capital Markets or the “State of SaaS” report from OpenView Partners. These reports provide invaluable data on metrics like CAC payback periods, growth rates, and NRR across the industry, allowing you to benchmark your performance against the best.