Designing Effective Sales Force Compensation: A Strategic Guide for Business Leaders

Posted in :

Sales teams are the engine of revenue growth, yet their performance is heavily influenced by how they are compensated. For business managers and directors, designing the right compensation structure is not merely an HR decision—it is a strategic lever that aligns incentives, drives growth, and shapes company culture. Drawing on decades of economic research and proven corporate practices, this guide examines how to develop compensation models that strike a balance between motivation, coordination, and long-term profitability.

Why Compensation Design Matters?

Sales compensation is, in essence, a contract between the company and its salespeople. Agency theory (the study of incentives between principals and agents) explains that poorly designed contracts can lead to misaligned goals, short-termism, or destructive competition within teams. Conversely, effective compensation aligns individual incentives with organizational objectives.

At GrowGenics, we see compensation not as a cost but as a strategic investment in building scalable, sustainable sales performance.

Common Sales Force Compensation Models

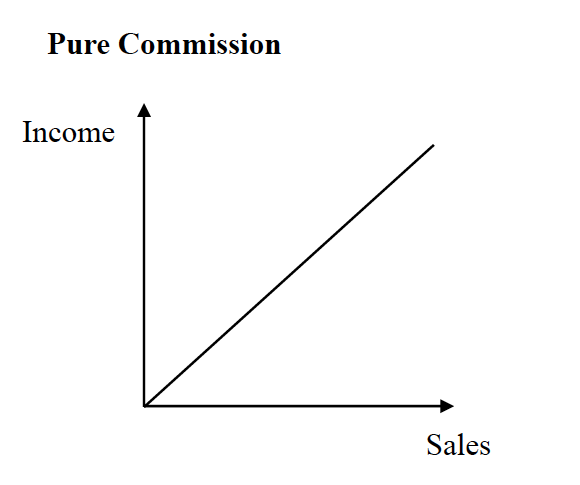

1. Pure Commission

-

How it works: Pay is entirely variable; income is tied directly to sales.

-

When to use: High-margin, transactional industries where effort directly converts into sales (e.g., insurance brokers, real estate).

-

Risks: Can undermine collaboration, lead to aggressive selling, and attract opportunistic profiles.

The pure commission model is a double-edged sword whose efficacy is entirely contingent on market dynamics and the nature of the product or service. In specific, narrow scenarios, it can be a highly efficient and low-risk compensation strategy. This is most viable when the product is already well-known and has a clear value proposition, the sales cycle is short and transactional, and competition is low. In such an environment—exemplified by industries like residential real estate or certain inbound insurance sales—the salesperson’s role is less about education and more about facilitation. The model efficiently aligns company and seller interests, maximizing revenue while controlling fixed costs, and attracts self-motivated, entrepreneurial individuals who thrive in a meritocratic system.

However, in the vast majority of modern B2B and complex B2C environments, a pure commission structure is a dangerously myopic strategy that can severely damage long-term company health. The primary failure is its fundamental misalignment with contemporary customer-centric values. It inherently encourages aggressive, short-term selling tactics that can erode brand reputation and customer trust. Furthermore, it critically undermines internal trust and collaboration, as noted by sales leadership experts like Zoltners, Sinha, and Lorimer in the Harvard Business Review, who point out that such plans can “foster unhealthy competition among salespeople, discourage knowledge sharing, and dissuade reps from working on long-term opportunities.” This environment attracts opportunistic profiles who may prioritize their own immediate commission over the company’s strategic goals, leading to high turnover of more consultative, relationship-building talent. Consequently, the company doesn’t just risk losing a single sale; it risks losing the loyalty of both its customer base and its most valuable, trust-driven sales professionals, sacrificing sustainable growth for unpredictable, often volatile, short-term gains.

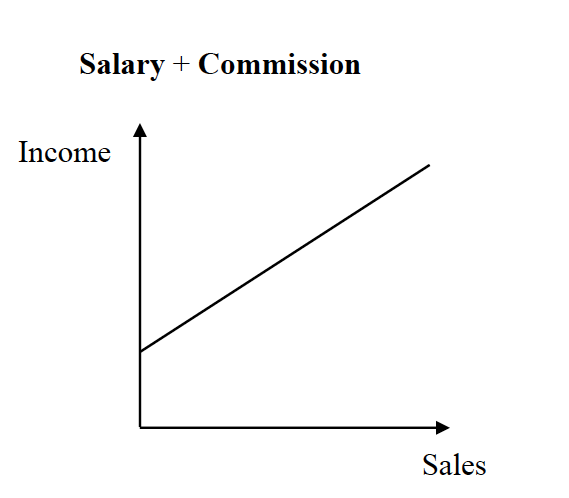

2. Salary + Commission

-

How it works: A fixed base salary with a commission for every sale.

-

When to use: Balances security with motivation; ideal for B2B sales where relationship-building matters.

-

Benefits: Ensures stability while incentivizing revenue generation.

The Salary Plus Commission model represents a strategic evolution from purely transactional compensation, designed to harness the benefits of both stability and performance-based incentive. From a business leadership perspective, this hybrid model is not merely a compensation structure but a powerful tool for shaping organizational culture, driving specific behaviors, and managing risk.

This model provides sales professionals with a guaranteed base salary, which covers their living expenses and acknowledges their value to the organization beyond closed deals. The variable commission component is then layered on top, directly rewarding achieved sales results. The strategic genius of this structure lies in its balance. The base salary acts as a retention tool, reducing financial anxiety and fostering loyalty. Simultaneously, the commission component preserves the motivational “upside” that attracts high-performing, results-oriented individuals. The ratio between base and variable pay (e.g., 60/40, 70/30) is a critical lever that management can adjust to signal strategic priorities—a higher base emphasizes account management and customer success, while a higher variable component prioritizes aggressive new customer acquisition.

As indicated, this model is the cornerstone for B2B sales environments and any scenario involving complex, relationship-driven sales cycles. This includes industries like enterprise software, medical device sales, industrial equipment, and professional services. In these fields, the sales process can take months or even years. A pure commission model would be untenable, as it would fail to attract talent willing to invest such extensive time without income security. The salary ensures reps can focus on nurturing leads, providing value, and building trust with clients—activities that are essential for long-term success but don’t have an immediate payoff. It aligns perfectly with the “land and expand” strategy common in SaaS and other subscription-based businesses.

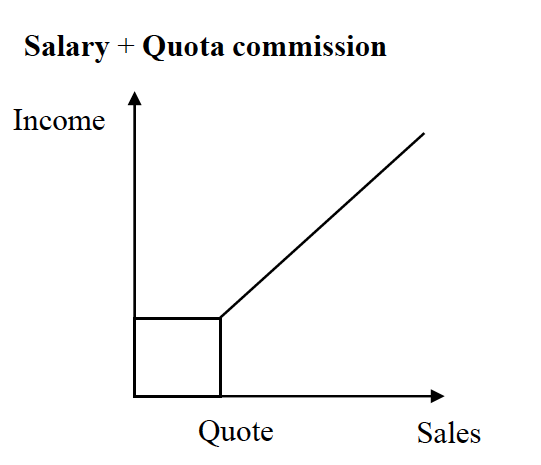

3. Salary + Quota Bonus

-

How it works: Bonuses are awarded upon meeting or exceeding sales quotas.

-

When to use: Common in structured sales environments where predictable growth is expected.

-

Challenges: Poorly set quotas can demotivate or cause burnout.

The quota-based bonus model is a performance management tool rather than a pure compensation strategy. It operates on a foundation of predictability and is designed to drive specific, pre-determined outcomes within a structured sales environment. From a business leadership standpoint, this model is less about motivating raw sales activity and more about aligning individual performance with meticulously crafted corporate financial forecasts and strategic goals.

How it Works & Strategic Rationale:

Employees in this model receive a fixed base salary, ensuring income stability. The variable component is a bonus that is explicitly triggered upon achieving a pre-defined sales quota or target. This target is often a key performance indicator (KPI) like revenue, units sold, or gross profit. The strategic intent is to create a clear, binary, or tiered (e.g., 100% of bonus at 100% of quota, with accelerators beyond) incentive that focuses effort on hitting a specific number crucial to the company’s operational plan. This transforms the sales target from a abstract goal into a direct financial imperative for the employee.

This structure is predominant in established companies and structured sales environments where forecasting accuracy and predictable growth are paramount. It is ideal for roles where the sales process is well-defined, territories are balanced, and market potential is reasonably predictable. Examples include:

-

Account Management: Where the goal is to upsell and retain a existing book of business.

-

Inside Sales: In mature markets with a high volume of inbound leads.

-

Roles with long, complex cycles: Where the base salary covers the long nurturing period, and the bonus rewards the eventual close, ensuring reps don’t abandon long-term opportunities for quick wins.

Benefits and Advantages:

The primary benefit is strategic alignment and financial control.

-

Predictability: It allows finance and leadership to model costs and revenue with greater accuracy, as a significant portion of variable pay is contingent on hitting a specific target.

-

Clear Goal-Post: It eliminates ambiguity. Reps know exactly what number they need to hit to earn their bonus, which can create intense focus.

-

Manageable Risk: The company’s financial exposure is capped and directly tied to achieved revenue, protecting margins.

-

Promotes Consistency: It rewards sustained performance against a benchmark rather than sporadic, high-value transactions, which can be beneficial for business health.

The infamous drawback of this model is its total dependence on the accuracy and perceived fairness of the quota itself. A poorly set quota is not just a minor error; it is a critical failure that can dismantle team morale and performance.

-

Demotivation and Burnout: If quotas are perceived as unattainable due to market conditions, poor territory assignment, or unrealistic expectations, it leads to rapid demotivation. Reps may disengage entirely, believing the bonus is out of reach, or burn out trying to hit an impossible target.

-

The “Sandbagging” Effect: In environments where quotas are based on past performance (a common practice), top performers may intentionally underperform in one period to secure a more achievable quota in the next, thus gaming the system to guarantee their bonus. This directly inhibits maximum growth.

-

Undermines Collaboration: It can foster unhealthy competition if not carefully managed, as reps may hoard leads or information to ensure they personally hit their quota, damaging team cohesion.

-

Strategic Inflexibility: It can discourage reps from pursuing valuable but non-commissioned activities, such as training, mentoring, or working on strategic accounts that won’t pay out within the bonus period.

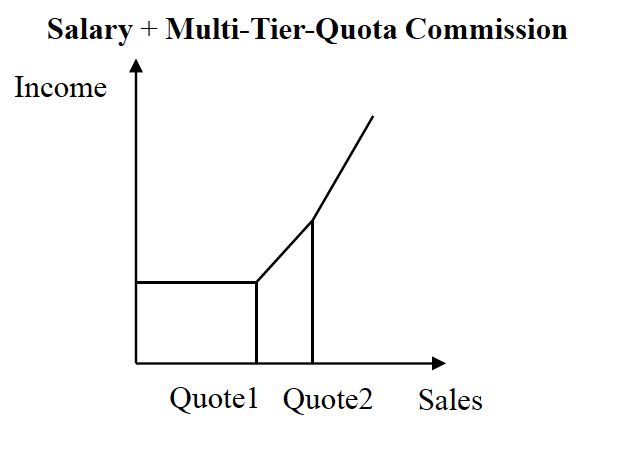

4. Salary + Multi-Tier Quota Commissions

-

How it works: Commissions increase as sales exceed different tiers of quotas.

-

When to use: High-growth industries or competitive markets (e.g., SaaS, FMCG).

-

Benefits: Motivates overachievement and rewards top performers disproportionately.

The tiered commission model is a sophisticated compensation strategy designed to maximize revenue growth by strategically leveraging behavioral economics. It moves beyond simply rewarding performance to actively encouraging exponential overachievement. From a business leadership perspective, this model is a powerful tool for creating a high-performance culture and aggressively capturing market share, but it requires precise calibration and a deep understanding of its psychological impact on the sales force.

Under this structure, a salesperson earns a standard commission rate up to a certain quota threshold (e.g., 100% of goal). However, upon surpassing that threshold, their commission rate increases for all subsequent sales, either within that same period or for sales beyond the threshold. For example, a rep might earn 5% commission on all sales up to 100% of quota, but 8% on every dollar sold beyond 100%. Some plans feature multiple tiers (e.g., 5% to 100%, 8% to 125%, 10% beyond 125%), creating a powerful financial accelerator for top performance. The strategic intent is to make the opportunity cost of stopping at “good enough” painfully clear to the rep, financially incentivizing them to push far beyond their initial target.

This model is quintessential for high-growth, high-velocity industries where market competition is fierce and market share is the primary objective. It is perfectly suited for:

-

Software-as-a-Service (SaaS): Where recurring revenue (ARR/MRR) is the lifeblood, and landing + expanding accounts is critical.

-

Fast-Moving Consumer Goods (FMCG): To motivate distributors and sales teams to push products aggressively through channels and outperform competitors on shelf space.

-

Startups in Scale-Up Phase: To create a “land grab” mentality and reward the monumental effort required to exceed ambitious early targets.

-

Roles focused on New Customer Acquisition: Where the value of displacing a competitor or establishing a new logo is exceptionally high.

Benefits and Advantages:

The benefits are directly tied to driving hyper-growth and creating a meritocratic, performance-oriented culture.

-

Motivates Overachievement: It directly solves the “quota sandbagging” problem. Reps are financially discouraged from holding back deals for the next quarter and are instead incentivized to blow their numbers out of the water.

-

Disproportionately Rewards Top Performers: It intentionally creates a wide earnings gap between median and top performers. This acts as a powerful magnet for elite “hunter” talent and makes them very expensive for competitors to poach, thereby improving retention for your best assets.

-

Maximizes Revenue Potential: By motivating reps to pursue every last deal in a period, the company often sees a significant surge in revenue at the quarter’s end, which can be the difference between missing and beating Wall Street expectations.

-

Clear ROI: The company only pays the higher commission rates on incremental revenue that it otherwise might not have captured, making the increased cost per sale a profitable investment.

Inherent Challenges and Risks:

This high-powered model introduces significant complexity and risk that must be managed aggressively.

-

Extreme Complexity in Administration and Forecasting: Calculating comp, especially with multiple tiers and rollover rules, becomes administratively burdensome. More importantly, forecasting company revenue becomes more volatile as it becomes dependent on reps hitting accelerators.

-

Can Foster Unethical Behavior: The immense financial pressure to hit accelerator tiers can lead to aggressive discounting, selling inappropriate solutions, or booking low-quality deals that will churn, ultimately eroding profitability and brand reputation.

-

Demotivates the Middle and Bottom: While it excites top performers, it can demoralize mid-tier reps who see the accelerator tiers as unattainable, potentially increasing turnover in this segment.

-

Territory Disputes: Can lead to intense conflicts over lead distribution and territory boundaries, as access to the best opportunities directly dictates who can reach lucrative tiers, undermining teamwork.

Balancing Fixed vs. Variable Pay

The biggest question for executives is: What proportion of pay should be fixed vs. variable?

-

More variable pay → Increases effort and short-term sales but reduces coordination and may damage collaboration.

-

More fixed pay → Builds loyalty, cooperation, and stability but may weaken individual motivation.

Best Practice: For SMEs and startups, begin with a hybrid model (50–70% fixed, 30–50% variable) to ensure financial security while rewarding performance. For mature firms, tilt toward performance-driven tiers.

Strategic Considerations for Business Leaders

-

Sales Force Structure

-

Internal vs. external teams require different incentive systems.

-

Outsourced reps may need higher commission-heavy plans.

-

-

Cultural Alignment

-

Too much commission may create an “every man for himself” culture.

-

Balanced systems encourage collaboration and knowledge sharing.

-

-

Attracting the Right Talent

-

High-risk commission-heavy models attract aggressive hunters.

-

Stable, base-heavy models attract relationship builders.

-

-

Scalability & Growth

-

Compensation must adapt as the company scales. What works for a startup may fail in a multinational expansion.

-

Case Studies & Insights

-

Salesforce leverages quota-based compensation with accelerators for overachievers, driving competitive performance while maintaining alignment with company growth goals.

-

Microsoft shifted from high individual commission plans to team-based incentives in its enterprise sales division, increasing collaboration and improving customer satisfaction scores.

-

A Harvard Business Review study found that hybrid salary-commission models reduce turnover by up to 32% compared to pure commission schemes, underscoring the importance of stability in sales organizations.

Challenges in Compensation Design

- Quota Setting: Unrealistic targets erode motivation, while low targets cap growth.

-

Overemphasis on Individual Sales: Risks neglecting long-term client relationships.

-

Complexity: Overly complicated systems reduce transparency and trust.

Best Practices for Adoption

-

Align with Strategy: Compensation must directly support the company’s strategic priorities (market share, growth, retention, etc.).

-

Keep it Simple: Ensure every salesperson understands how they earn.

-

Incorporate Team Metrics: Blend individual and team performance indicators.

-

Review Regularly: Reassess annually to reflect changing markets and business needs.

-

Link to KPIs & Frameworks: Use advanced qualification systems (e.g., MEDDIC, MEDDPICC) to ensure revenue is sustainable and predictable.

Conclusion: From Theory to Execution

Designing sales force compensation is not a one-time HR exercise—it is a strategic driver of growth. For business leaders, the goal is to craft a system that motivates effort, fosters collaboration, attracts the right talent, and aligns seamlessly with corporate objectives.

At GrowGenics, we specialize in helping organizations diagnose their sales structures, design incentive frameworks, and build compensation systems that turn volatility into predictable growth.

🚀 Contact us today for a customized compensation audit and discover how the right structure can unlock your sales force’s full potential.

References:

- Zoltners, A. A., Sinha, P. K., & Lorimer, S. E. (2006). “The Complete Guide to Sales Force Incentive Compensation: How to Design and Implement Plans That Work.” (Published by AMACOM).

- “The Effort Paradox: How Quotas Can Sometimes Backfire” – This concept is explored in-depth by sales effectiveness researchers and is a staple topic in publications from The Harvard Business Review and Gartner.

- Gartner. (2020). “Reconsidering the Role of Commission in Sales Compensation.”